Most Singaporeans Will Be Priced Out From Buying A Private Property In The Near Future…

Find out why on this page!

The trend for Private Property prices in Singapore is clear and worrying. For the past 10 years it has been heading in 1 direction.

Upwards

Read on to see how this affects your next property investment decision.

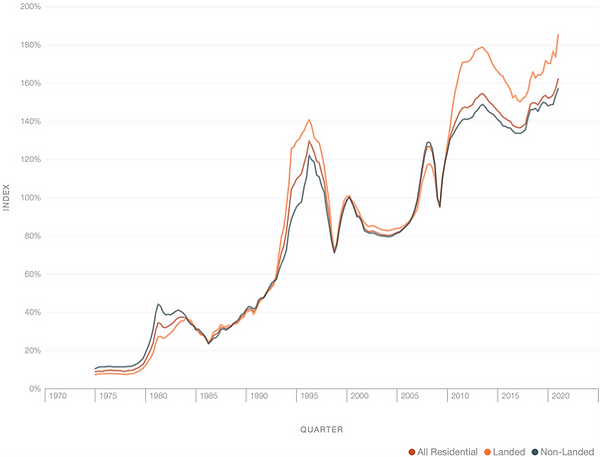

Singapore Private Property Price Index

(Source: Department of Statistics Singapore)

Most HDB owners seeing the high condo prices today. In fact, many are thinking of waiting for prices to drop before entering the market.

But after analysing the market data, here’s the cold hard truth that no one tells you…

But first - why should you listen to a word I say?

Hi, my name is David Lee, Senior Associate Director, PropNex.

Over the years, I have seen many families buy their homes with many misconceptions: some attempt to pay their loans too quickly, while others had no idea about the “negative valuation” problem that their homes were in.

These families would have lost hundreds of thousands of dollars due to a lack of knowledge - if they had not met me.

After managing many Singaporean's property portfolios over the past 6 years, these are the 💸 4 Reasons why Singaporeans will be priced out from private properties in the near future!

💸 Reason #1: Property Prices Are Actually Suppressed Now Due To High Interest Rates.

If your first reaction is "what?! seriously?"

You are not alone !

Take a look at the graph below and analyze the trend.

(Sources: www.housingloansg.com, Singstat, PropNex Research)

In 2013,

➡️ Interest rates fell from 5.04% to 3.98%

➡️ Properties prices increased by 62.2%

In 2020,

➡️ Interest rates fell from 4.54% to 2.96%

➡️ Properties prices increased by 18.9%

The surge in buyer demand actually jacks up property prices. And, the converse is true too.

When interest rates are high, property prices tend to fall or remain stagnant because:

🏠 Buyers become more prudent with their property purchases

🏠 Overall demand for new homes falls

🏠 Sellers are unable to raise their asking prices

That's why, contrary to what most people believe, now might actually be a really good time to explore the market.

In fact, some banks are even forecasting that interest rates are likely to fall again at the end of 2023.

When that happens, we can be sure that most of the people waiting in the sidelines today will rush into the market, in turn causing condo prices to surge again.

Would you rather enter the market now, when prices are stagnant, or rush in with the rest of the masses when interest rate gets low?

The truth is, a 4% to 5% interest rate might not add as much of a chunk to your mortgage as you think. At least work out the numbers so you have a clear idea of what your true outlay looks like - then make a decision based on objective data.

💸 Reason #2: The Price Gap Between HDBs And Condos Will Continue To Keep Widening.

Here’s the thing - HDBs were never meant as an investment.

That’s why the government will do what is necessary to ensure that HDB prices remain affordable i.e. HDB prices will not increase steeply.

While, as proven above in my first point, private property prices will continue to grow.

(Source: https://www.edgeprop.sg/market-trends)

If you look at the graph comparing PSF between HDBs & Private Properties above, you can clearly see that the price gap has widened to $1134 PSF in 2022 - a 60% increase from what it used to be just 10 years ago!

These prices mean that even if you manage to sell your HDB at a high price of $1M today, a similar sized condo will cost you up to $3M - which makes it almost impossible for most HDB owners to upgrade in the future.

Right now, HDB prices are probably still at their peak, and so it could be the best time to sell and unlock some cash for an upgrade. But this window is closing really soon. Why do I say so?

Agents on the ground like myself have seen the number of viewings for these higher quantum HDBs drop significantly recently. While it was easy to get 10-15 viewings per week just a couple months ago, we're seeing the numbers dry up to only 5-6 viewings per month.

From experience, all these signs will point to HDB sellers reducing their asking price, which will have a knock-on effect of HDB prices stagnating again.

This means the longer you wait to make the upgrade, the wider the price gap becomes and the less likely it is for you to be able to afford it.

💸 Reason #3 : Land Scarcity

Land scarcity is perhaps one of the most contributing factors to high costs in Singapore.

Singapore has a land area of 733.1 km² and a total population of 5,453,600, ranking it third in the world for population density.

With Limited land available for sale, when there is a land sale announcement, many developers would come in and bid aggressively for that plot of land to build on.

With higher land prices being bought the cost automatically translate to higher home prices.

A very good example is Hong Kong , with very limited land supply being the main reason of their sky high property prices today.

💸 Reason #4: Private Property Prices

WILL Keep Rising.

As much as we think the property prices are high today, the fact is, they are still fairly priced.

That's not just my opinion. If you look at one of the world's trusted sources on property prices - the UBS Global Real Estate Bubble Index, which I've pasted below - you can see that Singapore is NOT in a bubble, as opposed to other countries like the US, Switzerland, or Hong Kong.

.webp)

(Source: https://www.ubs.com/global/en/wealth-management/insights/2022/global-real-estate-bubble-index.html)

This means that property prices in Singapore are very unlikely to crash but instead will continue growing over time.

And yes, we've already seen private property prices grow 8.4% in 2022.

Most of your Instagram feeds and news headlines are probably sharing how the property market is fearful and slow.

But let me ask you this question:

Why are thousands of people still buying up properties in this climate?

1 week after New cooling measures were introduced.

Blossoms By The park

70% sales on launch day

Why?

Despite High interest rates

Singapore private property index is still rising

at a faster rate .

Why?

Could it be that these investors know something about the property market that you don't?

The truth is, property investors who have been in the market for many years understand the upcoming trend.

Do you know what is the plan for Singapore property sector moving forward in the next few years?

What should you as a potential property buyer or investor look out for?

So, What is the solution?

Should you wait till interest rates fall? Or till the economic outlook turns for the better?

Waiting for the ukraine war to end?

Do you wish to know what is the best solution for you?

You Cannot Afford to Wait… Literally!

If you always had the dream of owning a Condo, then you really shouldn’t wait for the price to drop.

Don't even think of trying to 'time' the market. I tell all my clients, don't try to "sell high, buy low" in today’s market. The longer you wait to take action only when “prices are right”, the further priced out you will be from being a private property owner.

So, the best thing you can do right now is to enter the market today - with strong financials and advice.

Here's How: Take The First Step Today & Leverage This Small Window Of Opportunity Before It Shuts On You

Book a FREE (no obligations, no sales) chat with me today and receive the following.

A FREE personalized plan of action to upgrade to a Private Property.

How to Upgrade to condo without even touching your savings.

Strategies on how to pay 50% lesser on interest rates even if you buy today

A great experience with David. he provide all the necessary information required. Giving good quality advices. He did his homework well and knowledgeable. Smooth transaction throughout. Keep it up mate, cheers.

David is a friendly and responsive agent. With his professional help and knowledge, we managed to sell off our house within the given time frame at a reasonable price. He is always prompt and patience in replying our queries. We are delighted to engage him as our agent. Would highly recommend him!

Suriana Senan

Very smooth transaction. We get to sell and buy our house in within a short period of time! Always there to answer our enquiries. Very friendly and knowledgable. Thank you David for making our journey an easy and enjoyable experience.

Let me accompany you on this journey while you still can

This might be your last window of opportinity to make the jump to a private property before prices surge truly out of your reach.

I want to help as many people to take action this year, because I know it will be even harder for you (and me) in the next few years.

At the very least, do yourself a favour, and do an honest check on your financials to see what opportunities you can seize today.

If it looks like you're not in a safe position to buy a private property this year, I'll tell you so, and I won't suggest any further action for you.

But what if you were in a good position to enter the market? Wouldn't you want to know?